There seem to be a lot of confusion around the Mayer Multiple. The most common misunderstanding is people assuming it can tell when to sell.

A short explanation is in order.

The Mayer Multiple was created with accumulation in mind. It was a simulation that aimed to find a good strategy to accumulated the most Bitcoins with a limited amount of US Dollars (the simulation will give different results with other currencies, depending on how their valuation changes). The idea was that if I have one USD to invest every day, should I invest it right now, or keep it and invest it later?

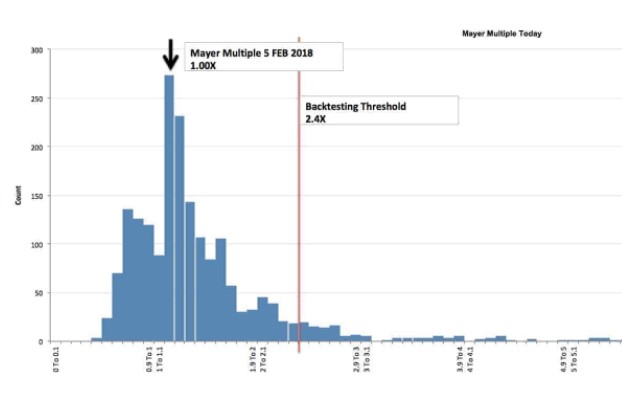

The result of that simulation was that above a ratio Price/MA200 of 2.4, it is more interesting to keep your money and invest it when the ratio is back below 1.

See the following charts from the previous cycle:

If you had stopped buying when the Mayer Multiple went above 2.4 and bought back with all your saved money when it went back below 1, that would have been a good accumulation strategy.

The same thing happened during the following bear market:

The important thing to remember is that the Mayer Multiple, and especially the value 2.4, does NOT indicate when to sell.

Also, keep in mind that this is not 100% accurate. The fake top in 2013 is a perfect example, as you can see below: after the first top, Bitcoin never went back down to its price when the Mayer Multiple was at 2.4. The best strategy at that time was to keep buying until the second 2.4 crossing.